The Definitive Guide to Business Debt Collection

Wiki Article

5 Easy Facts About Debt Collection Agency Explained

Table of ContentsDebt Collection Agency Can Be Fun For EveryoneThe Best Strategy To Use For Business Debt CollectionThe 9-Minute Rule for Dental Debt CollectionThe 30-Second Trick For Dental Debt Collection

The financial debt customer acquires just an electronic data of details, typically without sustaining proof of the debt. The financial debt is additionally typically very old financial debt, occasionally described as "zombie financial obligation" since the financial debt customer tries to restore a financial obligation that was past the statute of restrictions for collections. Financial debt collection firms might call you either in creating or by phone.

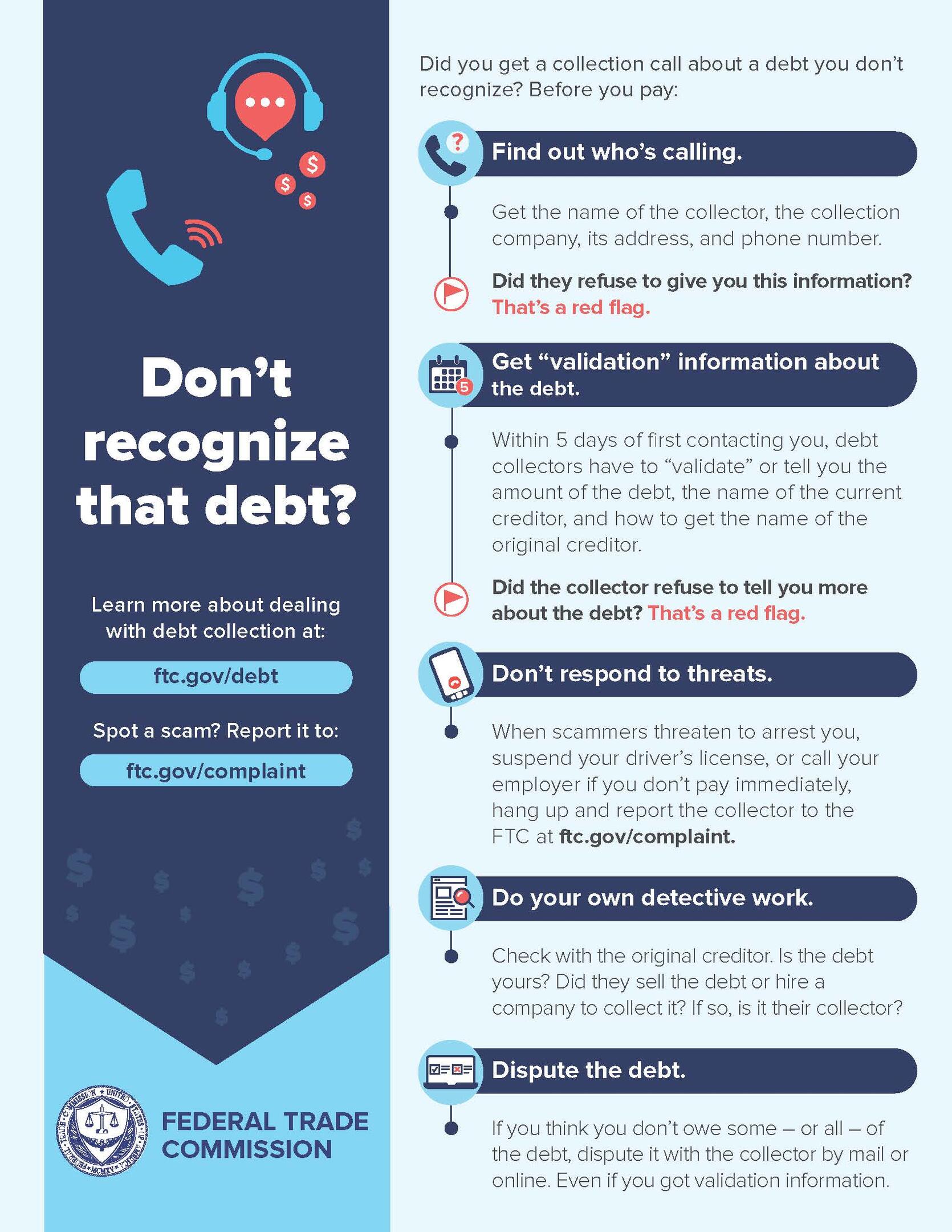

However not speaking with them will not make the financial debt vanish, as well as they might simply attempt alternate approaches to contact you, consisting of suing you. When a financial debt collector calls you, it is necessary to get some first details from them, such as: The financial debt enthusiast's name, address, as well as contact number. The total quantity of the debt they declare you owe, consisting of any type of fees and passion fees that might have accrued.

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)

Debt Collection Agency for Dummies

The letter needs to state that it's from a debt enthusiast. They should also inform you of your civil liberties in the debt collection procedure, as well as exactly how you can contest the debt.If you do challenge the debt within thirty day, they need to cease collection initiatives until they give you with evidence that the debt is yours. They have to supply you with the name as well as address of the original lender if you request that information within thirty days. The financial debt recognition notice have to consist of a type that can be utilized to call them if you wish to challenge the financial obligation.

Some things financial obligation collectors can refrain are: Make repeated phone calls to a borrower, intending to irritate the borrower. Threaten physical violence. Use profanity. Lie concerning just how much you owe or act to call from an official government office. Generally, unsettled financial debt is reported to the credit scores bureaus when it's one month past due.

If your financial obligation is transferred to a financial obligation collection agency or offered to a financial debt buyer, an entrance More Help will be made on your credit report. Each time your debt is offered, if it proceeds to go unsettled, one more entrance will be added to your credit history record. Each adverse entrance on your debt record can continue to be there for as much as seven years, even after the debt has been paid.

The smart Trick of Dental Debt Collection That Nobody is Talking About

What should you expect from a collection company as well as exactly how does the process job? As soon as you have actually made the choice to employ a collection agency, make sure you pick the right one.Some are better at obtaining outcomes from larger companies, while others are proficient at accumulating from home-based companies. Ensure you're collaborating with a firm that will in fact serve your needs. This may seem evident, yet before you employ a collection company, you require to ensure that they are qualified as well as certified to function as financial debt enthusiasts.

Prior to you start your search, comprehend the licensing requirements for debt collector in your state. That method, when you are interviewing agencies, you can talk wisely regarding your state's demands. Contact the firms you talk with to ensure they fulfill the licensing requirements for your state, especially if they are situated in other places.

You must also contact your Bbb and the Commercial Collection Agency Organization for the names of trusted and also very pertained to debt enthusiasts. While you might be passing along these debts to an enthusiast, they are still representing your business. You need to recognize exactly how they will certainly represent you, exactly how they will certainly deal with you, and what appropriate experience they have.

Facts About Personal Debt Collection Uncovered

index Just since a tactic is legal doesn't indicate that it's something you desire your business name connected with. A respectable financial debt enthusiast will certainly function with you to lay out a plan you can deal with, one that treats your former clients the method you 'd intend to be dealt with and also still finishes the job.If that occurs, one method lots of agencies utilize is miss tracing. You ought to likewise dig right into the collection agency's experience. Relevant experience enhances the chance that their collection initiatives will certainly be effective.

You need to have a factor of call that you can Get More Information communicate with and receive updates from. Business Debt Collection. They must be able to plainly verbalize what will be gotten out of you at the same time, what information you'll need to give, as well as what the cadence as well as activates for interaction will certainly be. Your chosen firm ought to have the ability to accommodate your chosen interaction requirements, not force you to accept their own

Regardless of whether you win such a situation or not, you wish to be certain that your business is not the one on the hook. Request for evidence of insurance from any type of debt collector to safeguard yourself. This is most usually called a mistakes and also noninclusions insurance plan. Financial debt collection is a service, and also it's not an inexpensive one.

Report this wiki page